Damaged Banknotes Policy

The Reserve Bank of Australia aims to have only good quality banknotes in circulation. This helps to maintain confidence in Australia's currency by making it easier for people to check the security features on banknotes and make it more difficult for counterfeits to be passed or remain in circulation.

The Reserve Bank works with authorised deposit taking institutions (ADIs) and cash centre operators to remove damaged banknotes from circulation as soon as practicable. The Reserve Bank provides a Banknote Sorting Guide to assist with this process.

The Reserve Bank provides a Damaged Banknotes Facility for eligible holders of incomplete or badly damaged/contaminated Australian banknotes making a legitimate claim, with the aim of ensuring that the public has confidence in Australian banknotes as a means of payment and a secure store of wealth.

Given the nature of the Damaged Banknotes Facility, it is important that the Bank establishes procedures to balance the competing priorities of providing an efficient claims handling process while reducing the risk that the Damaged Banknotes Facility could be used for criminal purposes. This policy describes the types of damaged banknotes and sets out the Bank’s requirements for processing damaged banknote claims under the Damaged Banknotes Facility.

Types of Damaged Banknotes

Incomplete Banknotes

A banknote with a significant piece missing is classified as incomplete. These banknotes may not be worth full value because the Reserve Bank needs to take into account the possibility that pieces of the banknote may be presented for value separately. The Reserve Bank’s policy is for the value of each piece of a banknote to be proportional to the part of the banknote remaining. In this way, the combined value paid for all the pieces presented should be the face value of the original banknote.

Subject to the Reserve Bank’s Claim Requirements, the Reserve Bank pays value for incomplete banknotes determined as follows:

| If less than 20 per cent of the banknote is missing: | Full face value is paid. |

| If between 20 and 80 per cent of the banknote is missing: | Value is paid in proportion with the percentage remaining, e.g. $5 value for half of a $10 banknote. |

| If more than 80 per cent of the banknote is missing: | No value is paid. |

For incomplete banknotes where between 20 per cent and 80 per cent of the banknote is missing, the assessed value is rounded to the nearest dollar based on the surface area remaining. The assessed value of an incomplete banknote can be estimated using the Reserve Bank Assessment Grids84KB, but will be determined by the Reserve Bank and may be different from an estimate made using those Grids.

The presence or absence of a serial number does not affect the assessed value of a claim (but see the section of the Claim Requirements headed ‘Reasons for rejection of claim’).

Because full face value is not paid on incomplete banknotes, care should be taken when accepting incomplete banknotes. There is no obligation to accept an incomplete banknote in payment or change.

Badly Damaged/Contaminated Banknotes

A banknote that has significant or unusual damage, such as:

- heat damage that prevents the verification of security features or affects 20 per cent or more of the banknote;

- damage that casts doubt on its value or genuineness; or

- contamination from substances that prevent handling (e.g. chemicals, blood, etc.)

is classified as badly damaged/contaminated.

Subject to the Reserve Bank's Claim Requirements, the Reserve Bank pays value for badly damaged/contaminated banknotes based on visual assessment and, at its discretion, other processes. If part of a banknote remains, the value is determined on the same basis as for incomplete banknotes.

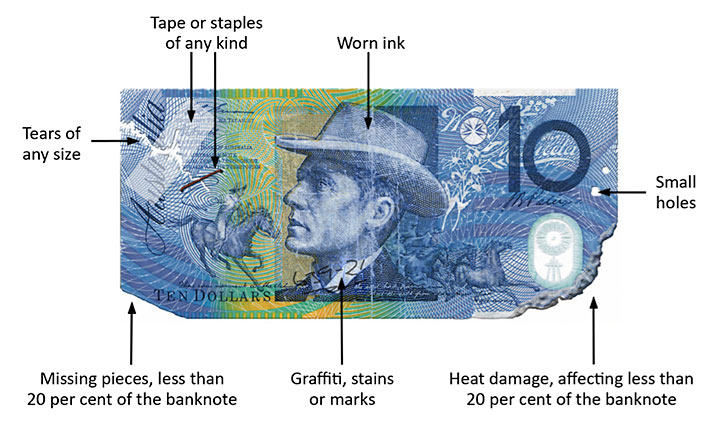

Unfit Banknotes

A banknote that has become worn or sustained minor damage is classified as unfit. Some examples of unfit banknotes are illustrated in the Reserve Bank’s Banknote Sorting Guide.

Even though these banknotes can continue to be used, to maintain the high quality of banknotes in circulation, the Reserve Bank has asked ADIs to remove any unfit banknotes from circulation.

While unfit banknotes are not generally covered by, or eligible to be the subject of a claim under, the Damaged Banknotes Facility, the Reserve Bank reserves the right, at its discretion, to treat unfit banknotes as if they were incomplete or badly damaged/contaminated banknotes. It may do so, for example, if an unfit banknote that does not strictly meet the requirements to be classified as badly damaged/contaminated has been included in a claim with badly damaged/contaminated banknotes. References in the Damaged Banknotes Policy and the Claim Requirements to incomplete or badly damaged/contaminated banknotes include any unfit banknotes that the Reserve Bank has determined to treat as incomplete or badly damaged/contaminated.